Homeowners Insurance in and around Wabash

Homeowners of Wabash, State Farm has you covered

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

Home Sweet Home Starts With State Farm

Our daily plans never block time for troubles or disasters. That’s why it makes good sense to plan for the unexpected with a State Farm homeowners policy. Home insurance covers more than your home. It protects both your home and your valuable possessions. In the event of vandalism or a burglary, you might have damage to some of your belongings beyond damage to the actual house. Without adequate coverage, the cost of replacing your items could fall on you. Some of the things you own can be insured against damage or theft outside of your home, like if your car is stolen with your computer inside it or your bicycle is stolen from work.

Homeowners of Wabash, State Farm has you covered

Help protect your home with the right insurance for you.

Safeguard Your Greatest Asset

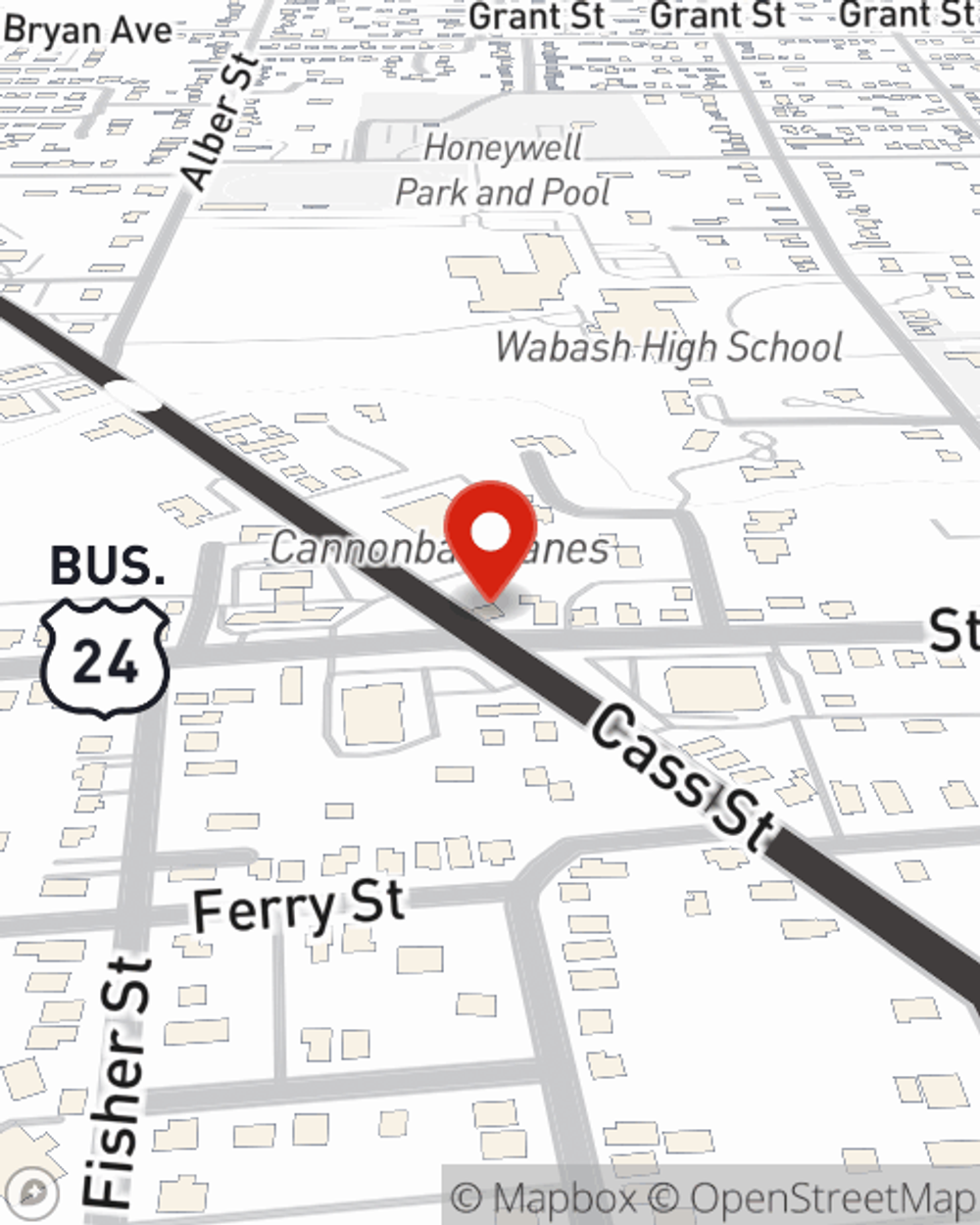

If you're worried about what could go wrong or just want to be prepared, State Farm's dependable coverage is right for you. Creating a policy that works for you is not the only aspect that agent Brian Mallow can help you with. Brian Mallow is also equipped to assist you in filing a claim if something does happen.

Now that you're convinced that State Farm homeowners insurance should be your next move, get in touch with Brian Mallow today to find out next steps!

Have More Questions About Homeowners Insurance?

Call Brian at (260) 563-5446 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Does car insurance cover motorcycles?

Does car insurance cover motorcycles?

Discover how motorcycle insurance differs from auto and homeowners insurance and verify you have the right coverages to help stay protected on the road.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

Brian Mallow

State Farm® Insurance AgentSimple Insights®

Does car insurance cover motorcycles?

Does car insurance cover motorcycles?

Discover how motorcycle insurance differs from auto and homeowners insurance and verify you have the right coverages to help stay protected on the road.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.